A lot changed in the last 25 days…

• Black Swan Event – unknown & unknowable

• World’s 2 biggest economies @ the core of the crisis –US & China

• Periodic lockdowns the new norm –“W” curve of the virus amongst the possible scenario of W, V,L & U

• Massive shifts in global supply chains -backlash against China

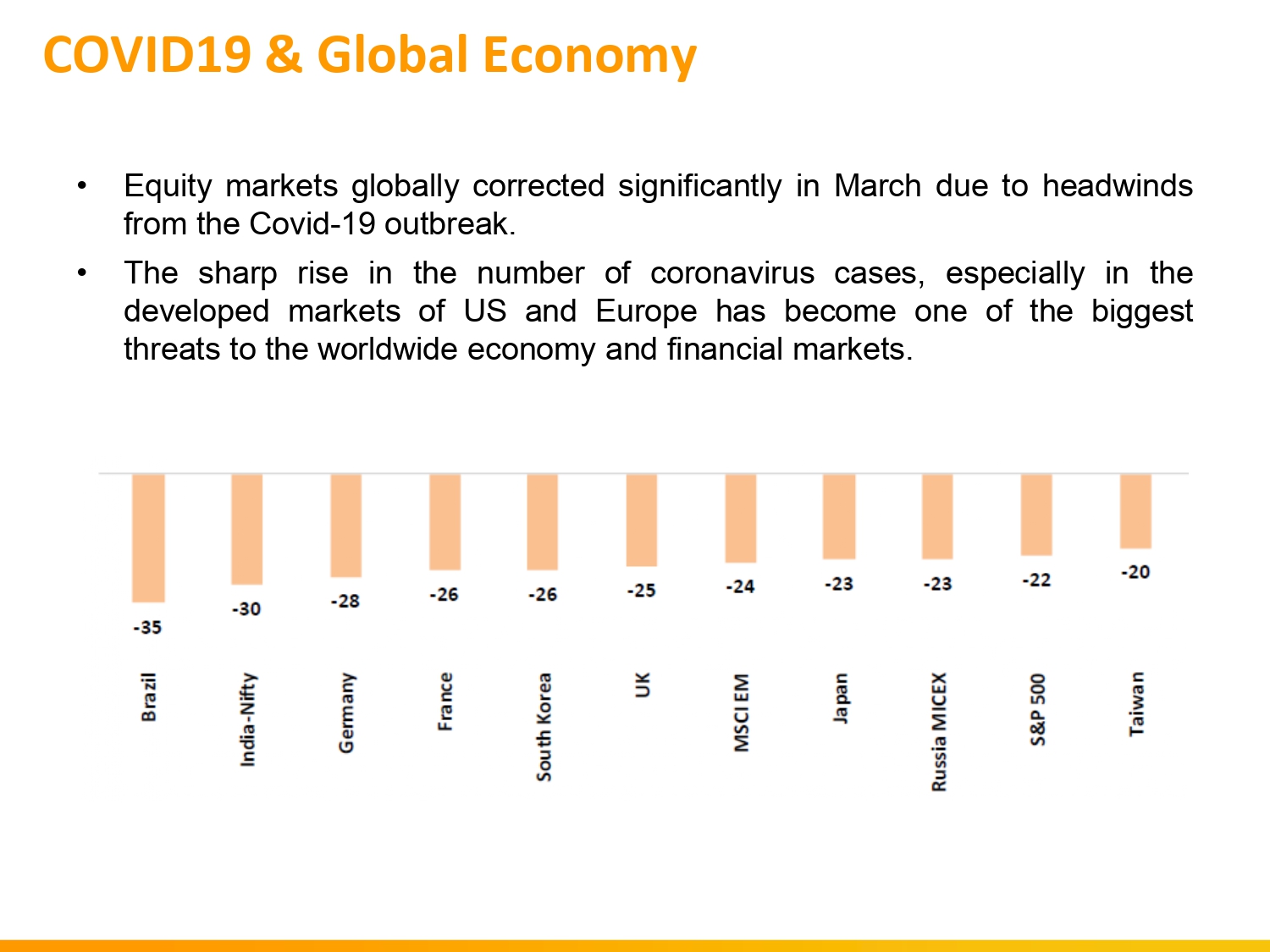

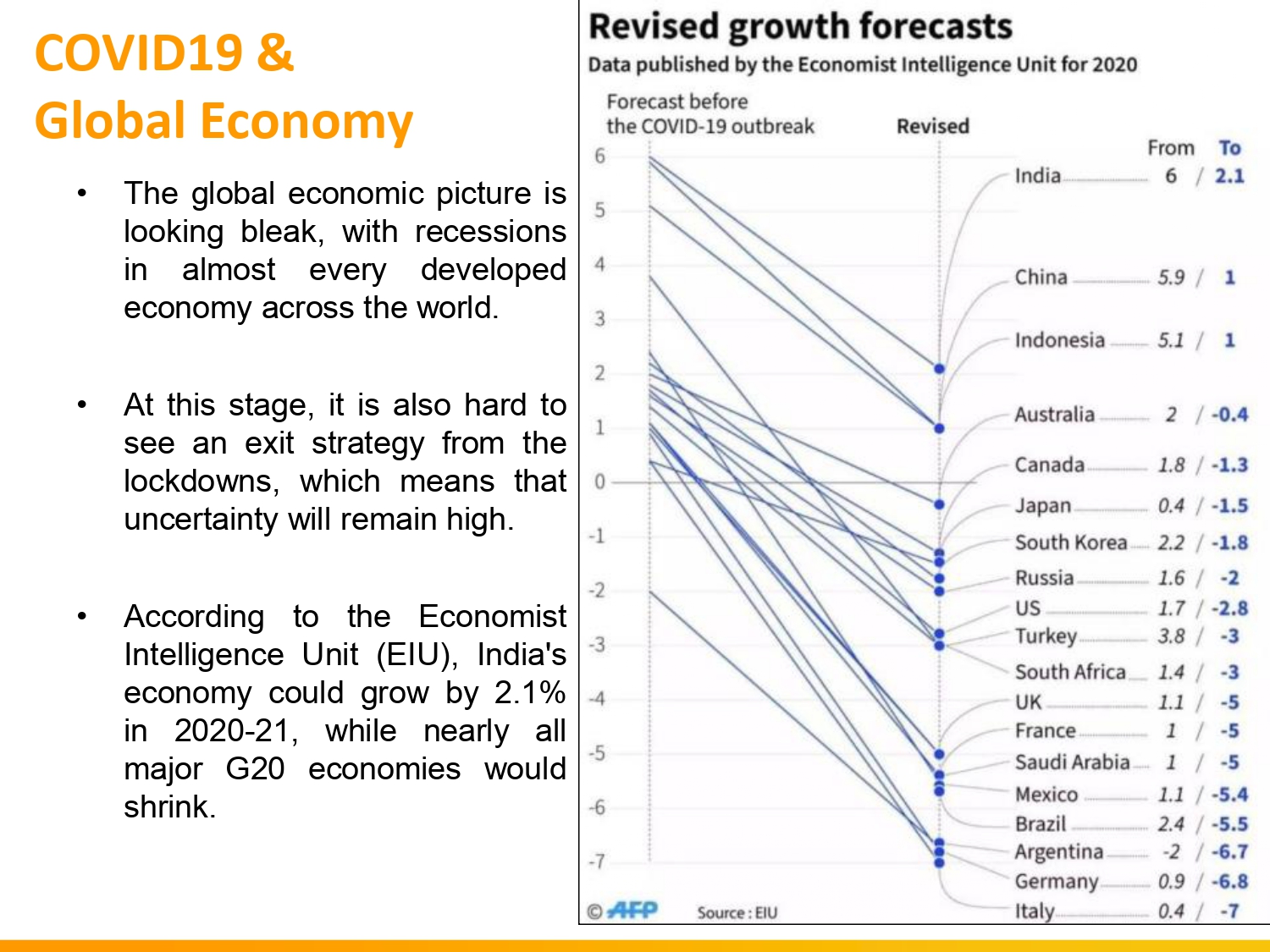

COVID19 & Global Economy

Massive GDP decline in US & EU @ 5-9% in FY21 | US unemployment expected to touch 20%

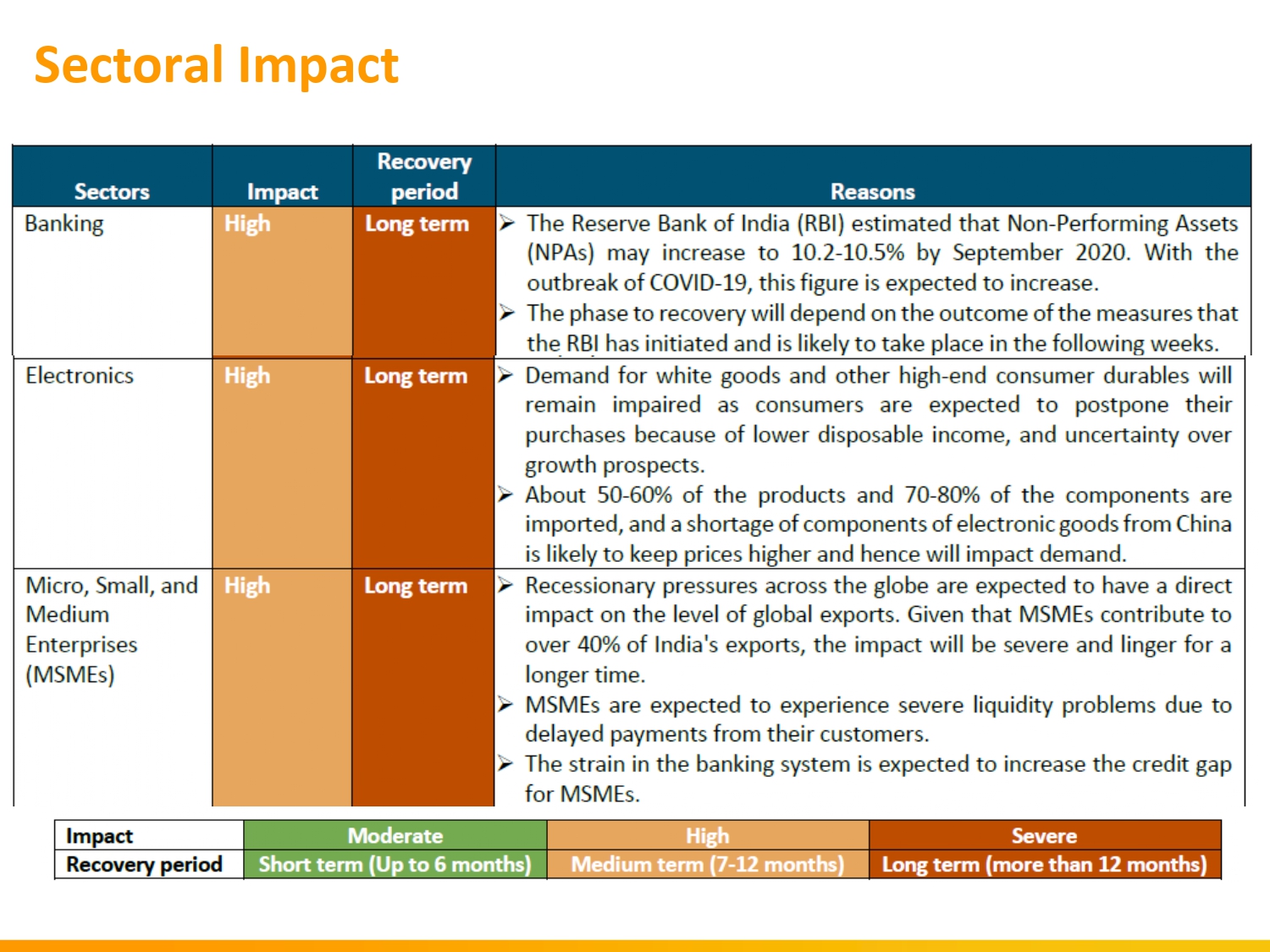

• Indian GDP expected to decline by 10-15%

• INR under pressure –3% YoY depreciation even in best times

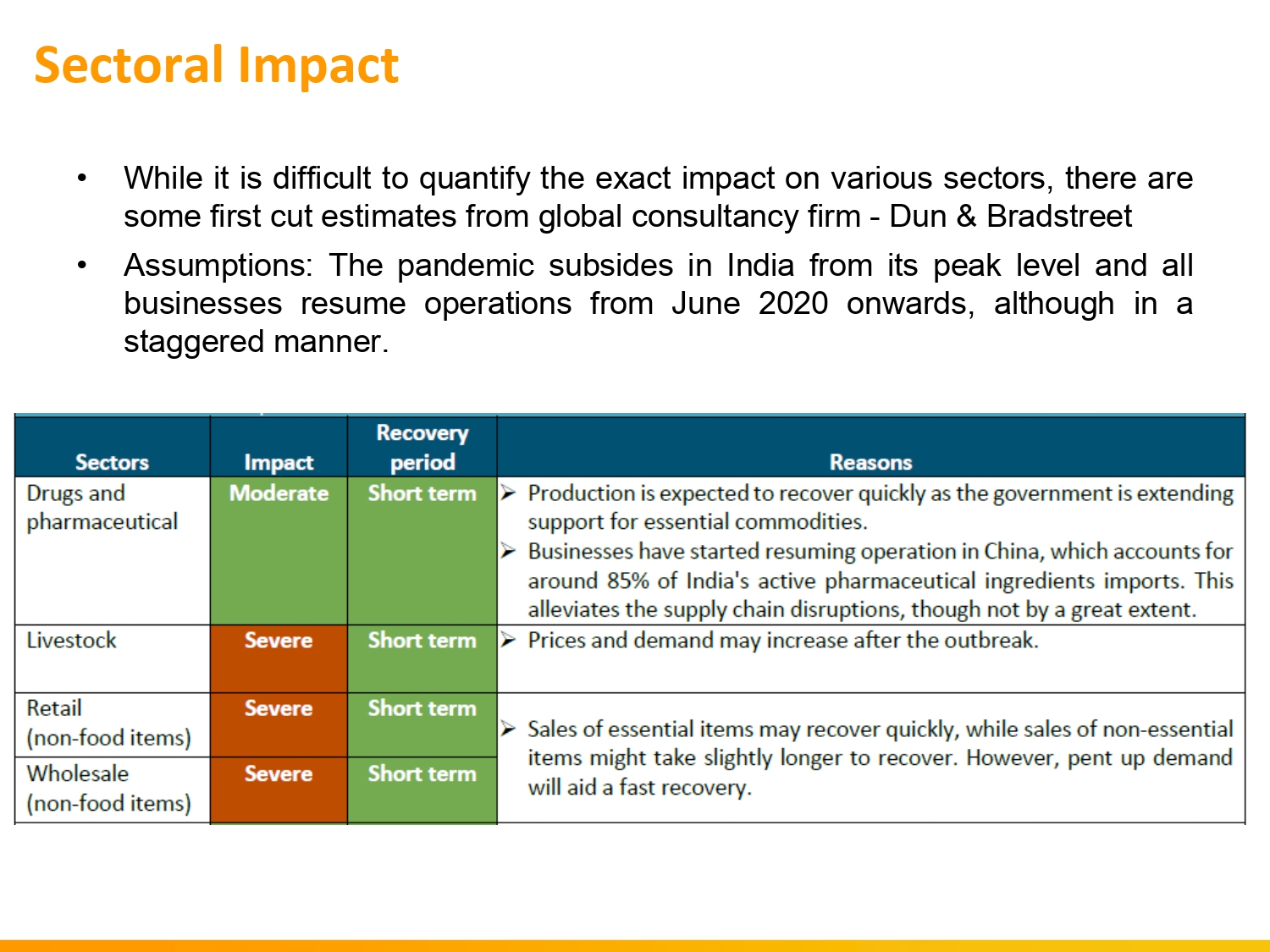

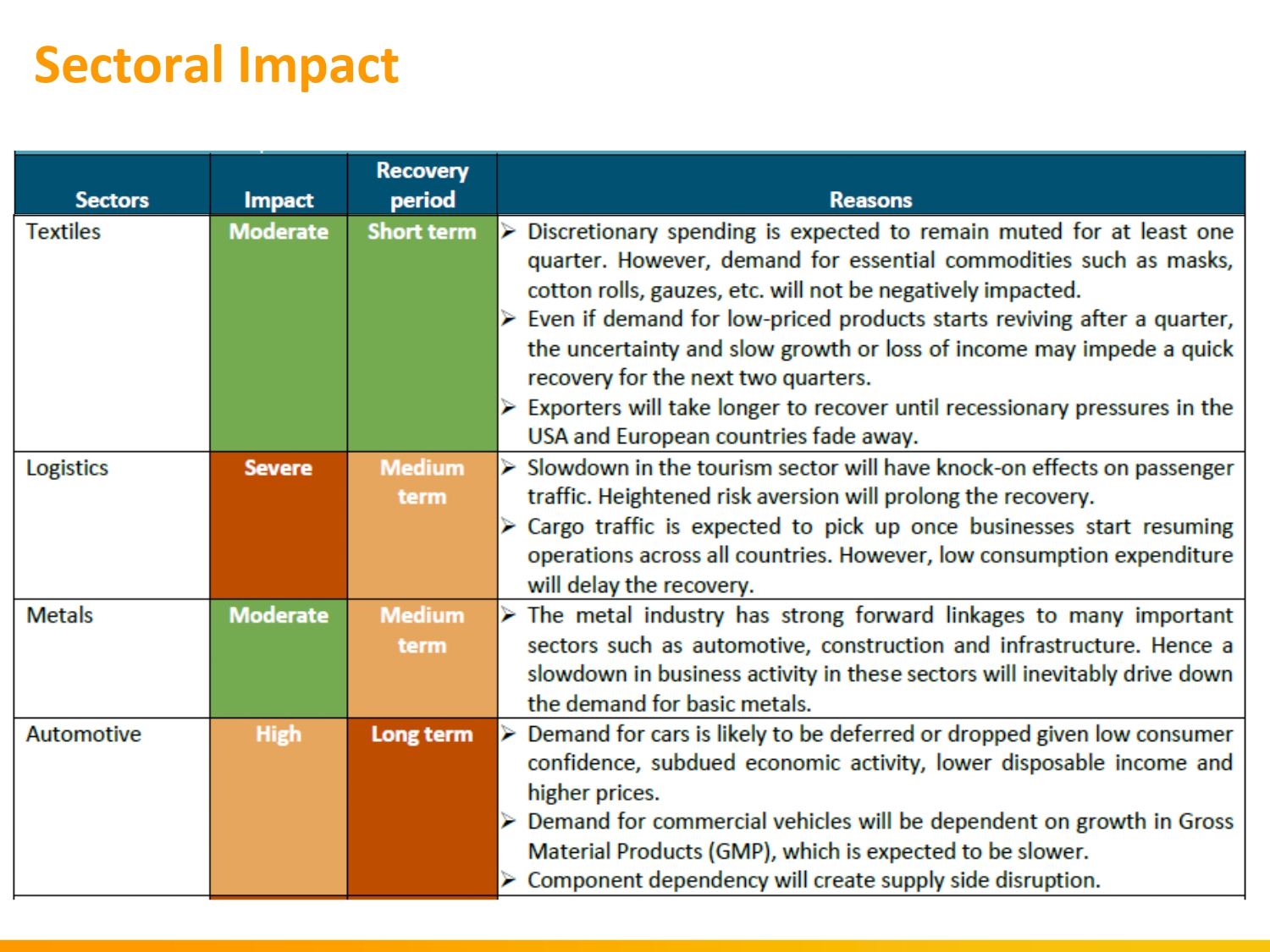

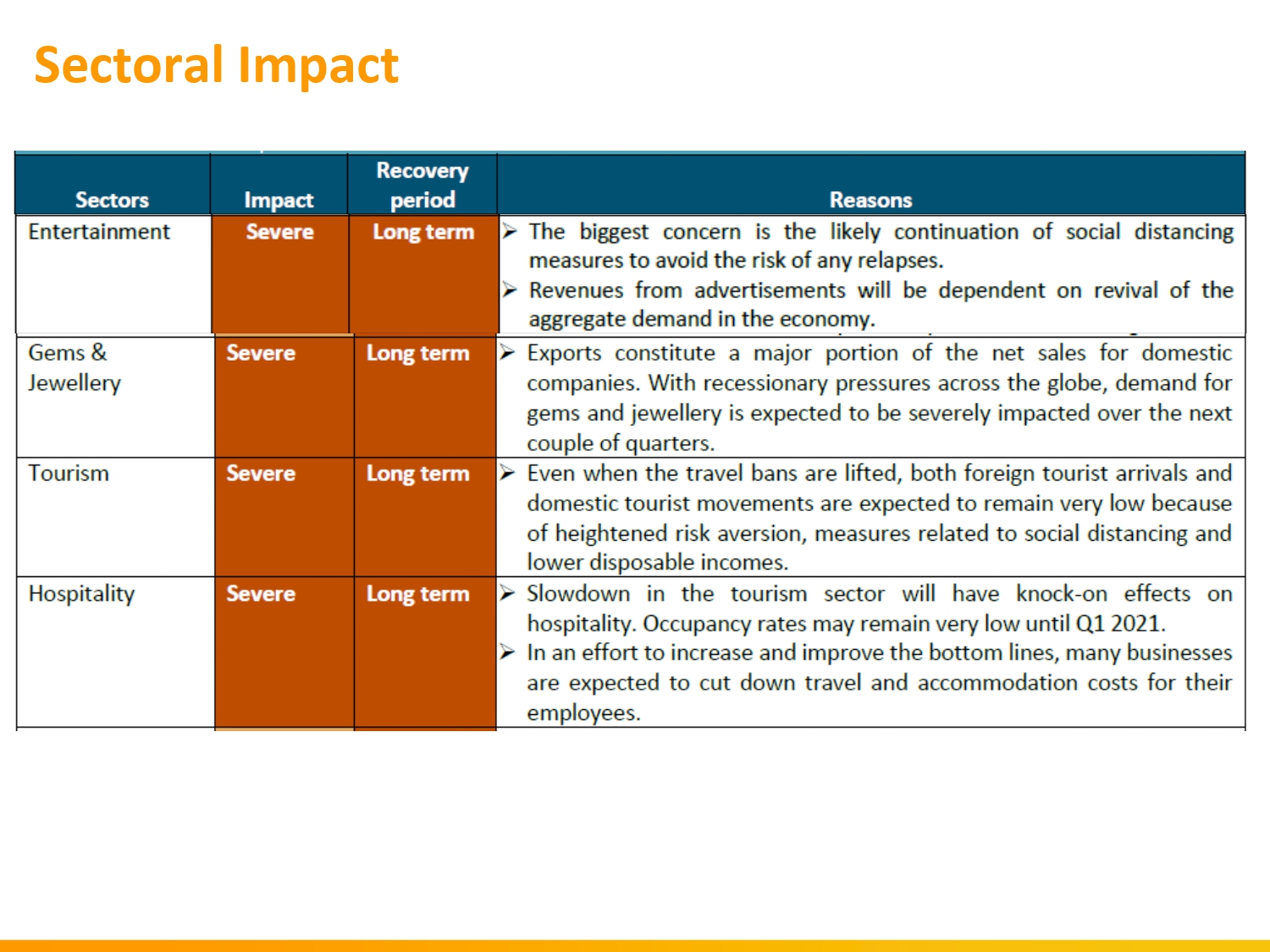

• Non-uniform impact seen across countries and industries

• Oil to remain between $40-$50

• De-globalization may kick-in even more

• Globally 300 cr people in border shut / lockdown areas

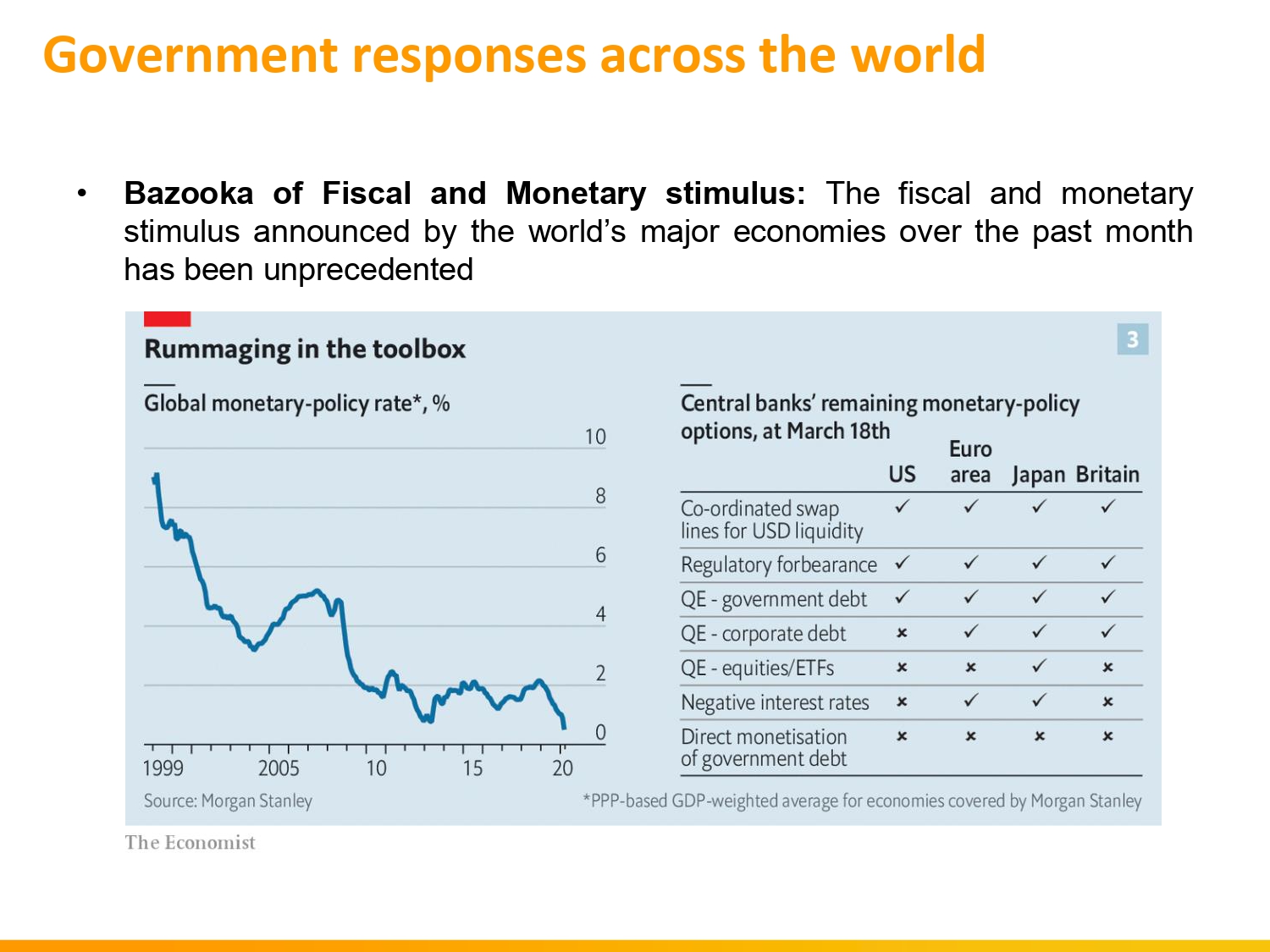

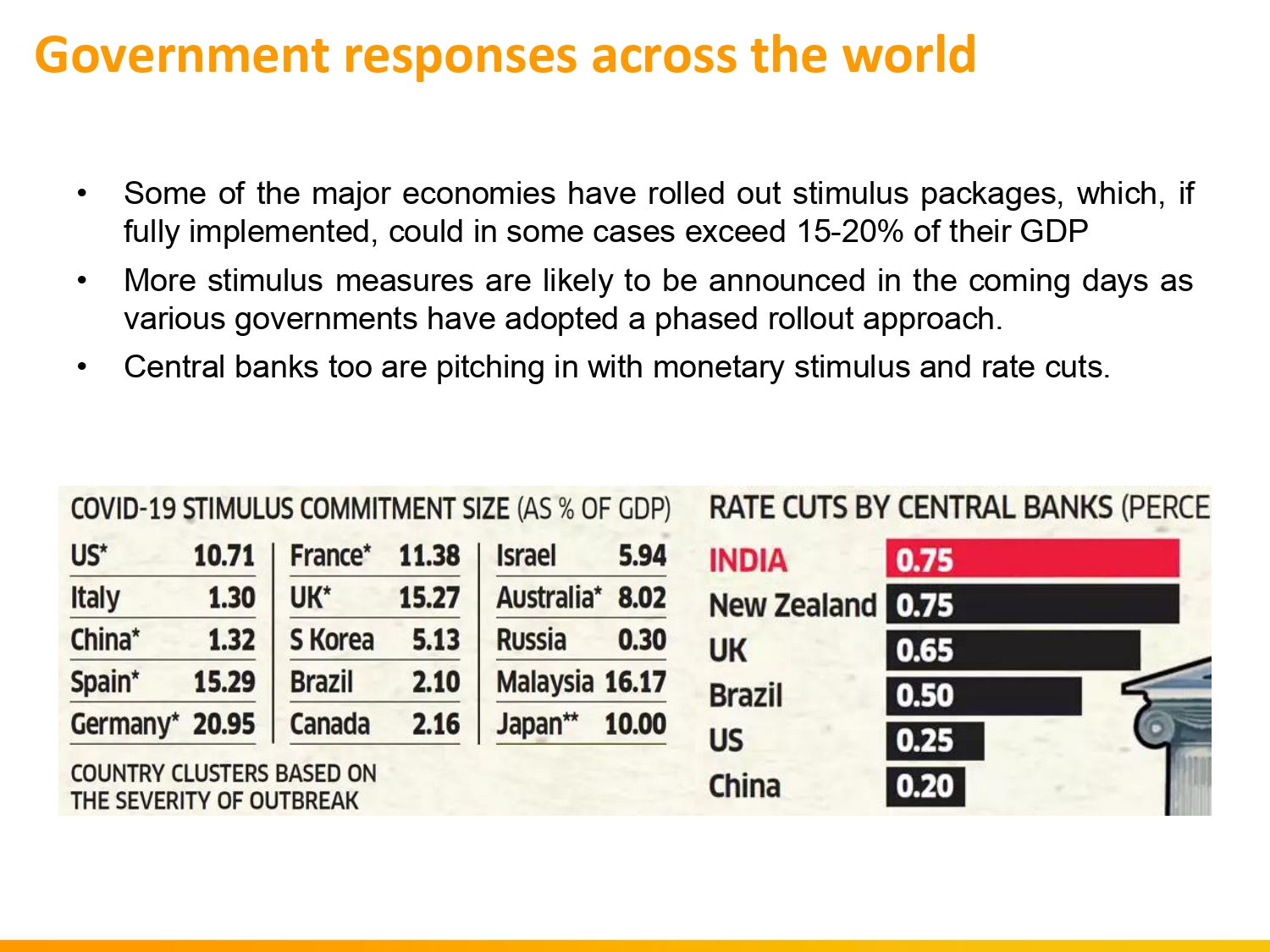

Government responses across the world

$15 trn stimulus already announced globally

India likely to announce INR 4 lakh cr (2% of GDP)

• US – fiscal deficit >19% of GDP

• Singapore – fiscal stimulus worth 12% of GDP

• EU wide reforms in the pipeline

• Global governments buying assets directly

• Rate cuts widely prevalent – US is almost zero

Implications for India

14k cases for 130 cr population–Health Crisis Managed

• ~390 mn population in middle class by 2023

• 24% Indian unemployment rate –highest ever

• Casual/ temp/ migrant workers-25% of total work force i.e. 10 crs in India-85% in agriculture & construction, 8% in manufacturing

• 7 cr MSME with 12 cr employees & 30% of GDP

• Exports fell by 34.6%in March | WPI inflation down to 1% | Combined fiscal deficit estimated at 12%-highest in 3 decades

• Big risk is breakdown in credit lines, which could lead to liquidity crisis, high number of bankruptcies & severe job losses

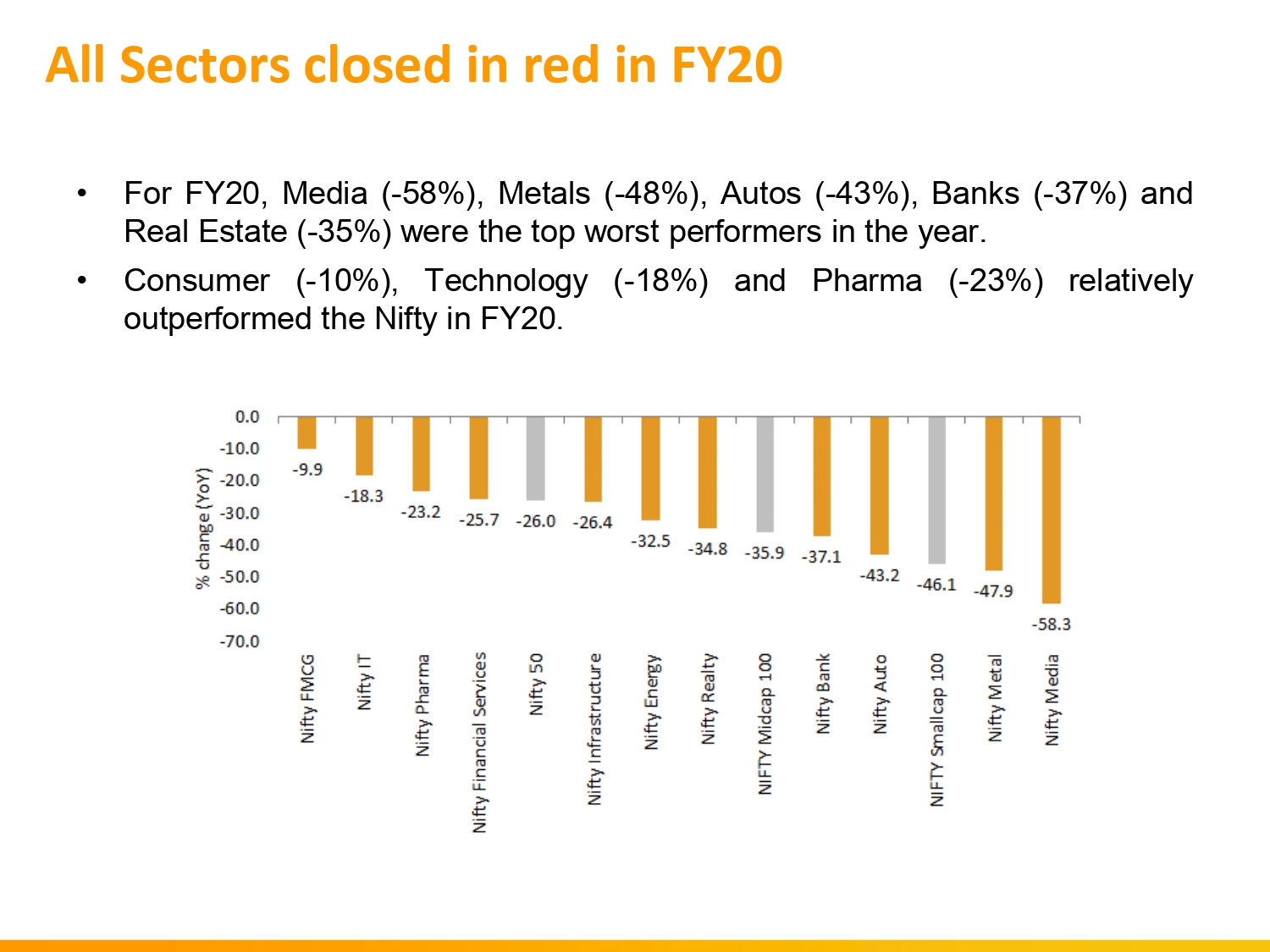

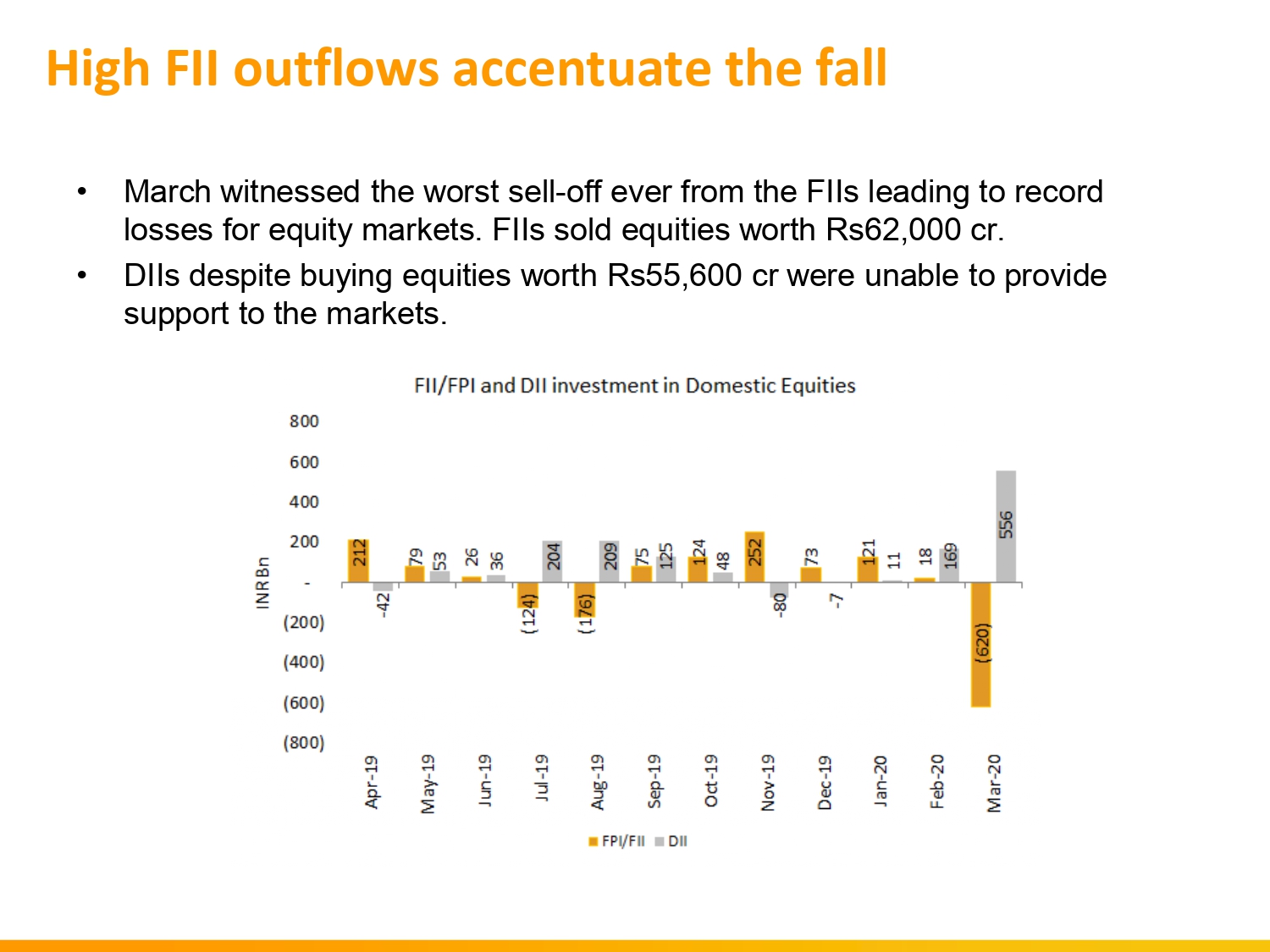

Market & Flows

• Pharma–top outperformer

• Investment in Insurance and Health expected

• Technology to be used extensively – newer ways of working

• Consumer spending –ticket size may reduce for sometime

India remains one of the top under performing markets globally

COVID –India, the Chinese alternative?

• The world will very differently from the communist China post COVID 19

• The dependence of most countries on China for not only the production scale it provides but also large consumer market will come down

• India will emerge as a natural choice in this switch

• It is already the back-office to the world

• has 55% of the world market share of global servicing sourcing business

• Worlds 3rd largest startup eco system

• 2nd largest producer of steel and cement

• 2nd largest mobile phone manufacturer

• Largest manufacturer of 2 wheeler and tractors

• 4th largest car producer

COVID –India, the Chinese alternative?

• India is a democracy and will always have free speaking press v/s a communist like China and hence a big advantage

• India has a very bright chance to reduce the world dependence on china and help maintain global growth

• It will very well believed that if there is any nation that can contain China other than US it is India

• Geo political & demographic advantage

• Skilled workforce

• Ability to offer scale

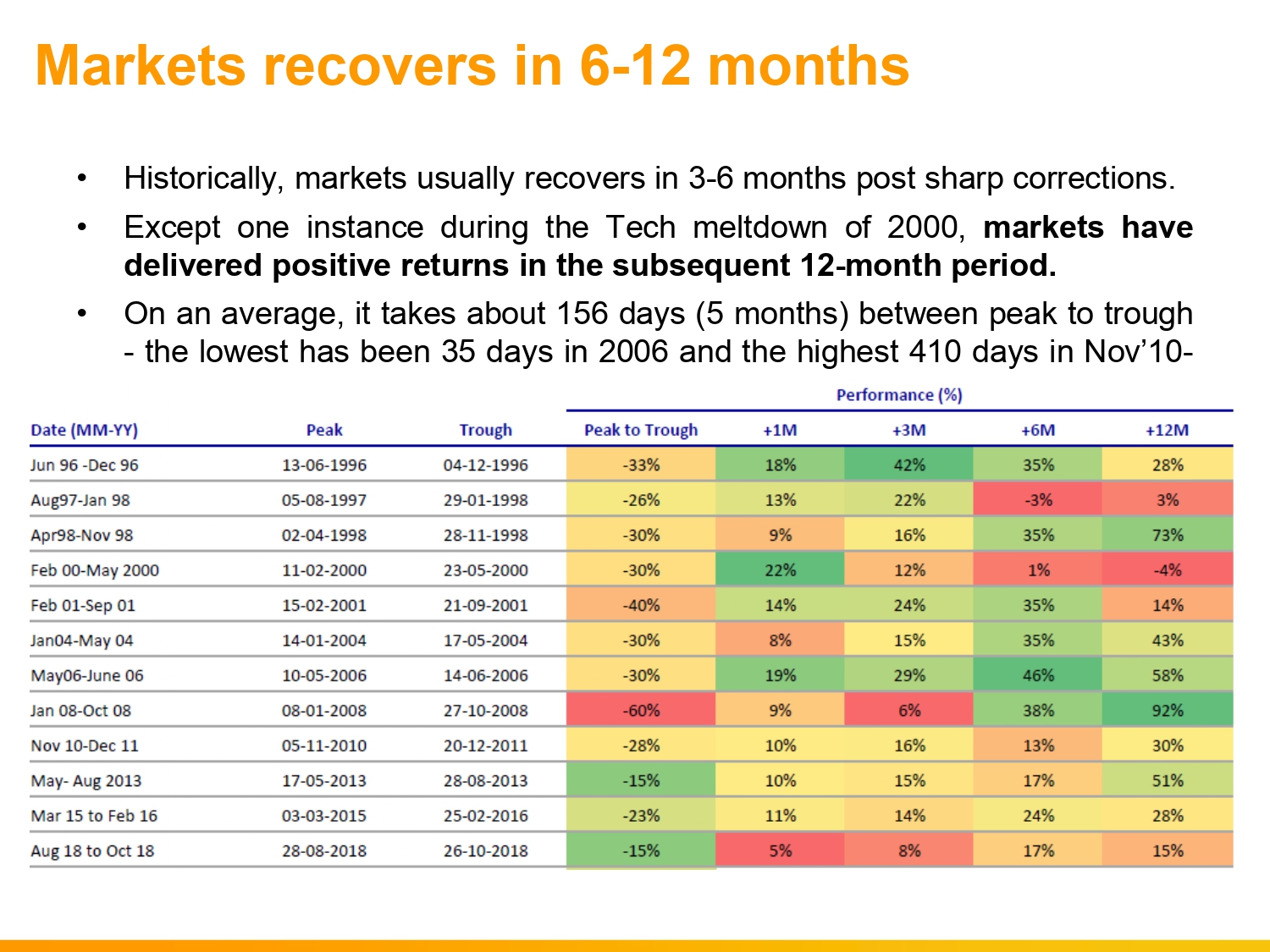

Buying into the mayhem made sense in the past

• Volatility is the friend of long term investors by making good stocks cheaper and attractive.

• The best strategy for investors would be to accumulate good fundamental and quality stocks gradually over the next few weeks and months.

• While it is very difficult to predict the bottom of the market, it always rewards investors in the long term who take the benefit of such sharp fall.

• Markets may continuet of all innear term, and that’s the time to start becoming greedy.

• We suggest accumulating 5-10 % of fresh allocation on a gradual basis.

• Remember “Cash is King”, especially in turbulent times. Hence, if any further correction were to happen in markets due to whatever reason, the Cash can be put to good use in such time.

Lessons for Corporates

Conserve | Stay to the Core | Phygital

• Conserve cash and Tight Cost Controls

• Build relationships with Bank

• Use ‘Phygital’ philosophy to keep client interest paramount

• Use daily ‘War Rooms’ & ‘Special Task Force’ –transform the business

• Increase equity in company, over capitalized is better than to be over leveraged, avoid the debt trap at all costs

• Payments from govt. will be a big issue , possibility of a lot of litigation will increase

Concluding remarks for individual contribution..

Safety First –EAT healthy | EXERCISE daily | LEARN daily

Re-invent yourself –it’s never too late

Identify “Good Costs” and “Bad Costs” and spend wisely!!

Source:Motiwal Oswal