Along with property ownership comes the responsibility to pay taxes. This is why an individual’s income from house property is taxed, based on its potential to earn a particular amount as rent, even if the unit is lying vacant. However, to make property purchases more lucrative, the government offers various tax benefits, especially if the property has been purchased using a home loan. In this article, we will discuss at length the various tax rebates that a home loan borrower can enjoy.

Home loan tax rebate

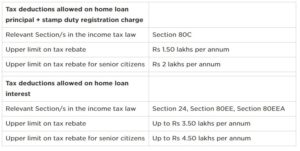

Home buyers enjoy income tax benefits on both, the principal and interest component of the home loan under various sections of the Income Tax Act 1961.

Deductions allowed on home loan principal

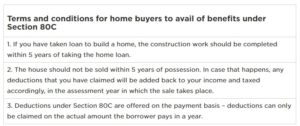

Section 80C Deduction

Available for: Property construction, property purchase

Can be claimed for: Self-occupied, rented, deemed-to-be-rented properties

Through Section 80C, nearly a dozen investment/expenditures, including payments made towards provident fund, public provident fund, life insurance policies, home loan principal, stamp duty-registration charge on property purchase, etc., have been made tax free. However, a tax payer can only claim up to Rs 1.50 lakhs in a year as deduction under Section 80C.

In fact, industry body CREDAI has suggested that in Budget 2021, the deduction limit under Section 80C for principal repayment on home loans be increased, to make the provision more exhaustive.

According to Amit Modi, director of ABA Corp and president-elect, CREDAI Western UP, the deduction of principal amount on housing loan should not be clubbed with other deductions under Section 80C. “The deduction should be allowed separately, over and above the limit of Rs 1.50 lakhs under Section 80C. The limit under Section 80C should also be increased to Rs 3 lakhs in the Budget 2021,” Modi said.

In light of the fact that our first tax-saving preferences are investment assets such as PF, PPF and life insurance policies at the start of our working careers, a middle-class tax payer typically exhausts this rebate limit much before they actually invest in a property.

Even if that is not the case and there is some scope for the tax payer to claim benefits towards home loan principal payment, it would be quite limited.

For example: If you are depositing Rs 50,000 a year in your PPF account (the upper limit here is Rs 1.50 lakhs a year) and pay another Rs 50,000 as you insurance policy premium (the minimum premium is Rs 20,000 per annum), you can only claim Rs 50,000 from your home loan interest payments under Section 80C, even if the annual outgo if much higher.

This is why there has been a long-standing demand that the deduction limit under Section 80C be increased, in order to justify the vast number of investment/expenditures it covers.

How to maximise tax rebate under Section 80C?

If a property is jointly owned, each co-borrower can claim Rs 1.50 lakhs as tax deduction on their respective incomes under Section 80C. For spouses to claim that benefit, they have to be co-owners, as well as co-borrowers.

Deductions allowed on home loan interest

Deductions for home loan interest repayment are offered under various sections of the income tax law.

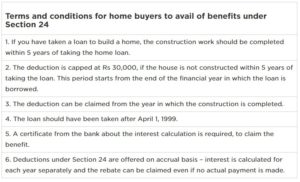

Deductions under Section 24

Available for: Property construction, property purchase

Can be claimed for: Self-occupied, rented, deemed-to-be-rented properties

Section 24 allows home buyers deductions of up to Rs 2 lakhs in a year towards interest payment. This cap, however, is only for self-occupied properties. In case the property has been given on rent or falls under the category of deemed to be let out, the entire interest amount paid is waived off as a deduction. In this case, however, the tax payers can only offset losses of up to Rs 2 lakhs under the head income from housing property in a year.

In case the loan money is to be used for the construction or purchase of a new property, the borrower can claim Rs 2 lakhs as deduction on pre-construction interest in a year, in five equal installments at the start of the year in which the property is constructed or purchased.

Deduction under Section 24 is also available to buyers who do not use home loan

Section 24 also allows buyers to avail of deductions, even if the buyer has used fund from his own sources to make the purchase, without seeking any home loan. Under the section, a flat 30% deduction on the net annual value of a property is available to the owner, if the house is purchased entirely using the buyer’s personal funds. However, this rebate will not be available if the property is self-occupied, since such properties do n0t have any net annual value under the existing tax laws.

How to maximise tax rebate under Section 24?

If a property is jointly owned, each co-borrower can claim Rs 2 lakhs as tax deduction on their respective incomes under Section 80C. In this case also, all the owners have to be co-borrowers.

Borrowers must also note that if they have paid more than Rs 2 lakhs as interest in a year, they have the option to carry the additional expense forward for another three years, to set off the losses. This option is available to only those property owners who are generating income from the house property.

Deductions under Section 80EE

Available for: Property purchase

Can be claimed for: Self-occupied, rented, deemed-to-be-rented properties

Section 80EE was introduced in financial year 2013-15 for two years, with an aim to make home ownership more lucrative for first-time home buyers, by offering rebate over and above the deductions under Section 80C and Section 24. At the time of its introduction, the deduction limit under this section was capped at Rs 1 lakh. However, when it was reintroduced for the financial year 2016-17, the rebate limit was capped at Rs 50,000 per annum.

How to maximise tax benefits under Section 80EE?

This benefit is no longer available to those applying for new home loans. However, borrowers who took the loan during the period when Section 80EE was applicable, can continue to claim higher benefits for their entire tenure. Since Section 80EE does not specify that the property must be self-occupied to claim the rebate, you can also claim the rebate on your rented or deemed to be let out property.

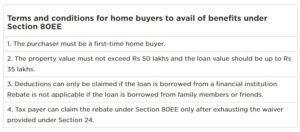

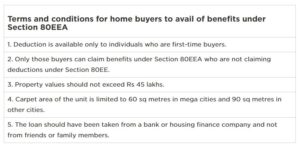

Deductions under Section 80EEA

Available for: Property purchase

Can be claimed for: Self-occupied, rented, deemed-to-be-rented properties

The then finance minister Piyush Goyal introduced Section 80EEA in the interim budget of 2019, with an aim to make home ownership more lucrative for the first-time buyer, by way of offering an additional deduction of Rs 1.50 lakhs in a year. Benefits under Section 80EEA were extended for another year during the Budget 2020 (up to March 2021). Owing to the difficulties caused by the Coronavirus pandemic, there has been a demand from sector stakeholders, to extend this time limit further, in order to incentivise buyers.

Benefits under Section 80EEA are over and above the ones offered under Section 80C and Section 24. Since the section doesn’t specify the point, it is understood that the benefits under are available for residents, as well as non-residents.

How to maximise tax benefits using Section 80EEA?

First-time buyers of affordable property can claim Rs 3.50 lakhs as interest deduction, by combining the benefits under Section 24 and Section 80EEA. Better still, if the property is jointly owned, the co-borrowers can individually claim Rs 3.50 lakhs per annum as tax benefit. Also, since Section 80EEA does not specify that the property must be self-occupied, you can claim the rebate on your rented or deemed-to-be-let-out property.

How much home loan can you get at your current salary?

FAQs on home loan tax benefit

How much tax benefit can I get on home loan?

Tax deduction on the principal component is limited to Rs 1.50 lakhs per annum under Section 80C, while rebate towards interest is capped at Rs 2 lakhs. Additional tax benefits are also offered to first-time home buyers under Section 80EE and Section 80EEA.

If I buy a property jointly with my wife, can we both claim tax benefits?

Both, the husband and wife, can separately claim deductions of Rs 1.50 lakhs under Section 80C and Rs 2 lakhs under Section 24 while filing taxes, as long as they are co-borrowers as well as co-owners of the property.

Can I claim deductions for under-construction property?

The buyer claims tax deduction towards interest payment, only after the completion of construction. After taking possession of the unit, the buyer can claim the entire outgo in five equal installments.

Can I claim tax benefits if I borrow money from family members or friends?

In such a case, deductions can only be claimed towards the interest component under Section 24. The person from whom you borrow the capital, would also be obliged to issue you an interest certificate, based on which your deduction claim would be accepted. The lender’s interest income would also be taxed, based on this document.

Can I claim tax benefit on stamp duty and registration charge on property purchase?

Deductions can be claimed under Section 80C of the Income Tax Act on stamp duty and registration charge paid on home purchase, under the overall limit of Rs 1.50 lakhs per annum. This claim can, however, be made only in the year when the property was purchased.

Can I claim home loan tax benefit along with HRA?

A tax payer can claim home loan tax benefits along with house rent allowance in two scenarios. A: he is paying EMI for an under-construction project. B: he is living in a rented accommodation while his own property is also let out. In the latter scenario, his income from house property would be taxable.

My wife and I are co-borrowers and co-owners of a property, but I pay 70% of the EMI. In what proportion can we claim tax deductions while filing income tax returns?

The tax break is shared by each party in proportion to his contribution towards the EMI repayment.

Can I claim tax benefits on two home loans?

Yes, you claim deductions on two home loans within the specific limit under Section 24 (Rs 2 lakhs per annum) if the properties are self-occupied. Only for your first home, you can claim benefits under either under Section 80EE or 80EEA. For your second home, no deduction is available on the principal payment.

How can I calculate tax benefit on home loan?

Almost all banks offer online calculators that help borrowers arrive at the amount they can claim as income tax rebate. You will have to key in details such as loan amount, loan tenure, interest rate, annual income, etc., while using the online calculator.

What is an interest certificate?

Your lender issues you a certificate each year, specifying the amount you pay every year as principal and interest component of the loan home. The tax payer has to submit this certificate, to claim deductions.

What are the exclusive tax benefits for first-time home buyers?

Only first-time buyers can claim deductions under Section 80EE and Section 80EEA. This helps them make their combined deductions as high as Rs 5 lakhs per annum. The benefit will double, if the property is jointly owned.

Source: Housing News